What is Financial Planning?

Financial planning is a comprehensive process of setting, managing, and achieving financial goals through a systematic approach. It involves evaluating your current financial situation, including income, expenses, assets, and liabilities, and then creating a plan to optimize your financial resources to meet your short-term and long-term objectives.

Why is Financial Planning important?

Financial planning is essential as it empowers individuals to set clear financial goals, manage their resources efficiently through budgeting, minimize financial risks with insurance and emergency funds, optimize taxes and retirement savings, reduce debt while building wealth, and adapt to life's changes with financial security. Ultimately, it offers peace of mind and ensures a stable financial future for individuals and their families, allowing them to achieve their aspirations and protect their loved ones.

What are the key components of a Financial Plan?

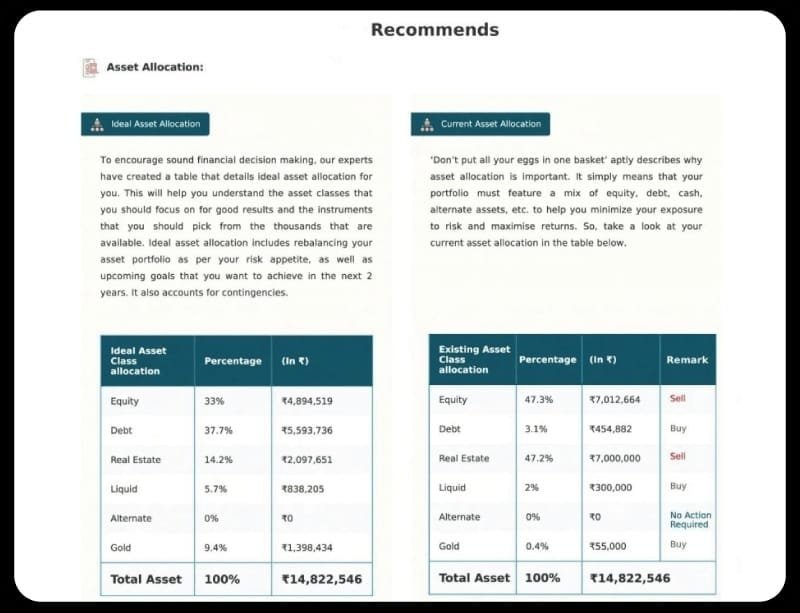

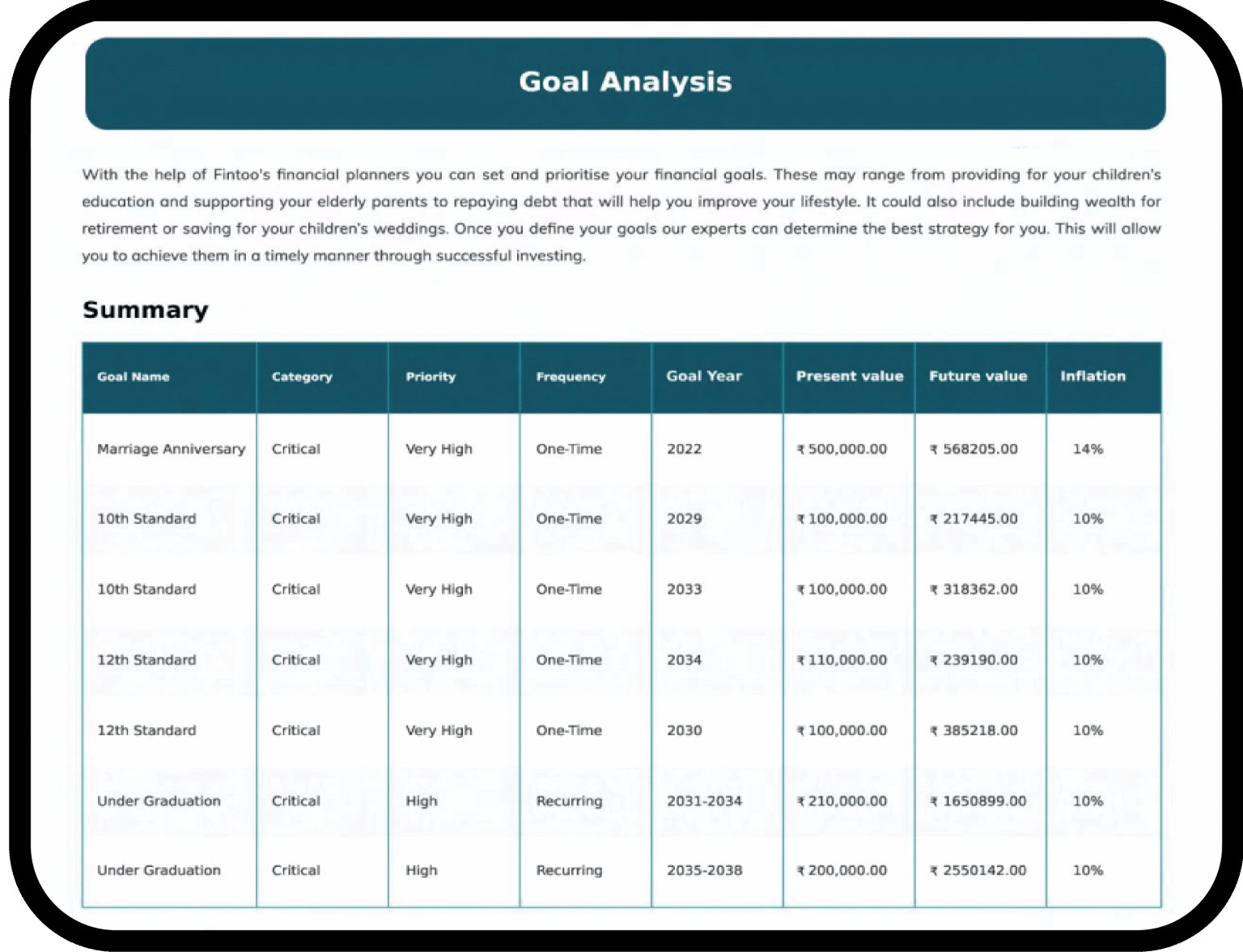

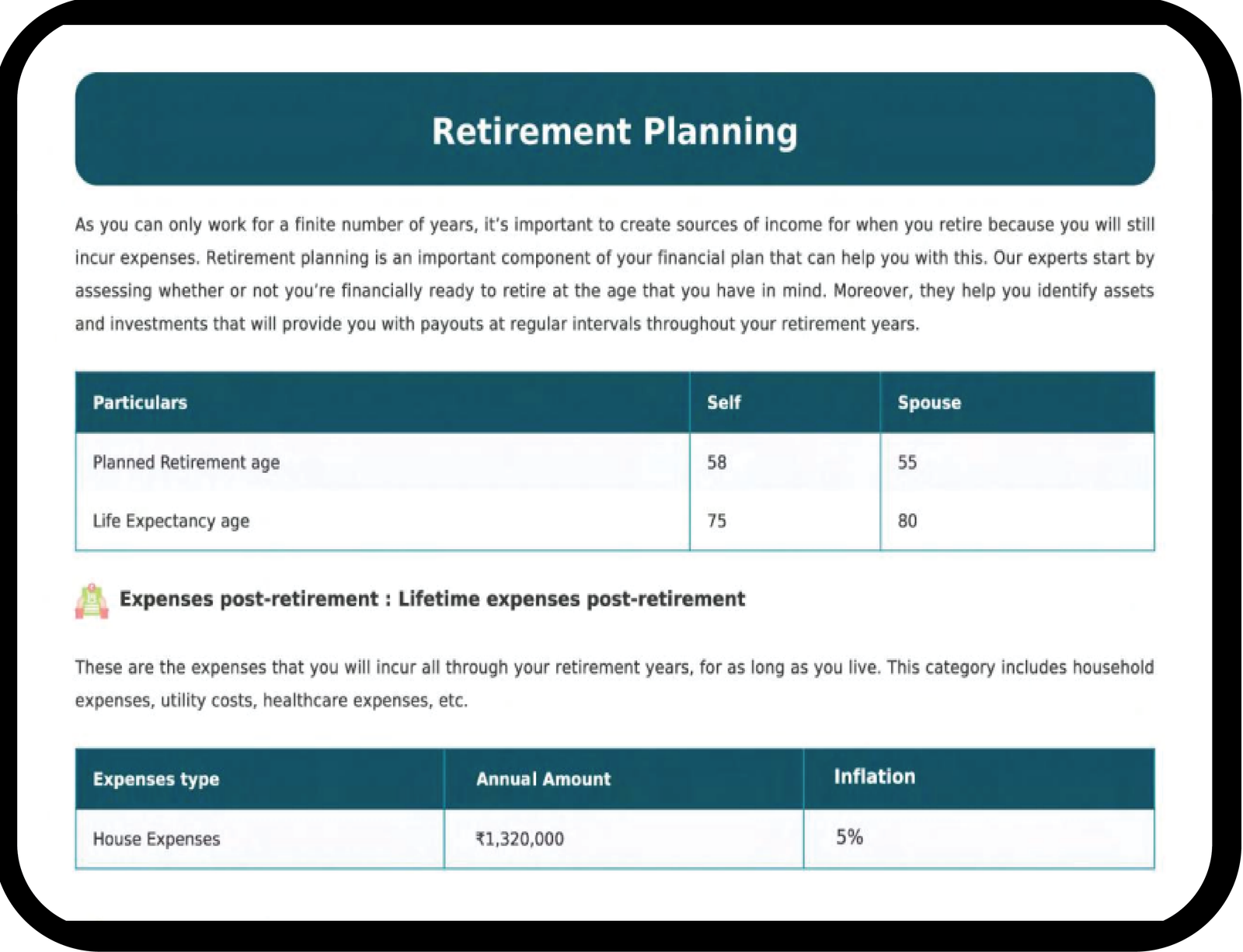

A financial plan consists of several key components, including setting clear financial goals, assessing your current financial situation, budgeting, managing debt, investing wisely, planning for retirement, and mitigating financial risks. These elements provide a comprehensive framework for achieving your financial objectives and ensuring long-term financial security.

How can I create a budget?

To create a budget, start by calculating your monthly income and listing all your expenses. Categorize expenses as fixed like rent and insurance and variable such as groceries and entertainment. Allocate funds for savings and emergencies and set spending limits within your income. Regularly track expenses, prioritize building an emergency fund, and consider paying off high-interest debts. Review and adjust your budget as needed to stay on track with your financial goals.