Life is a magnificent journey with its share of joys, challenges, and uncertainties. At every twist and turn, having the right insurance coverage can provide you with a safety net and peace of mind. Just as your needs change as you progress through different life stages, so should your insurance policies. In this blog, we will delve into the importance of tailoring your insurance coverage to different life stages and provide valuable insights on how to make the right choices.

As you embark on your journey into adulthood, insurance may not be the first thing on your mind, but it's a crucial foundation. Consider these policies:

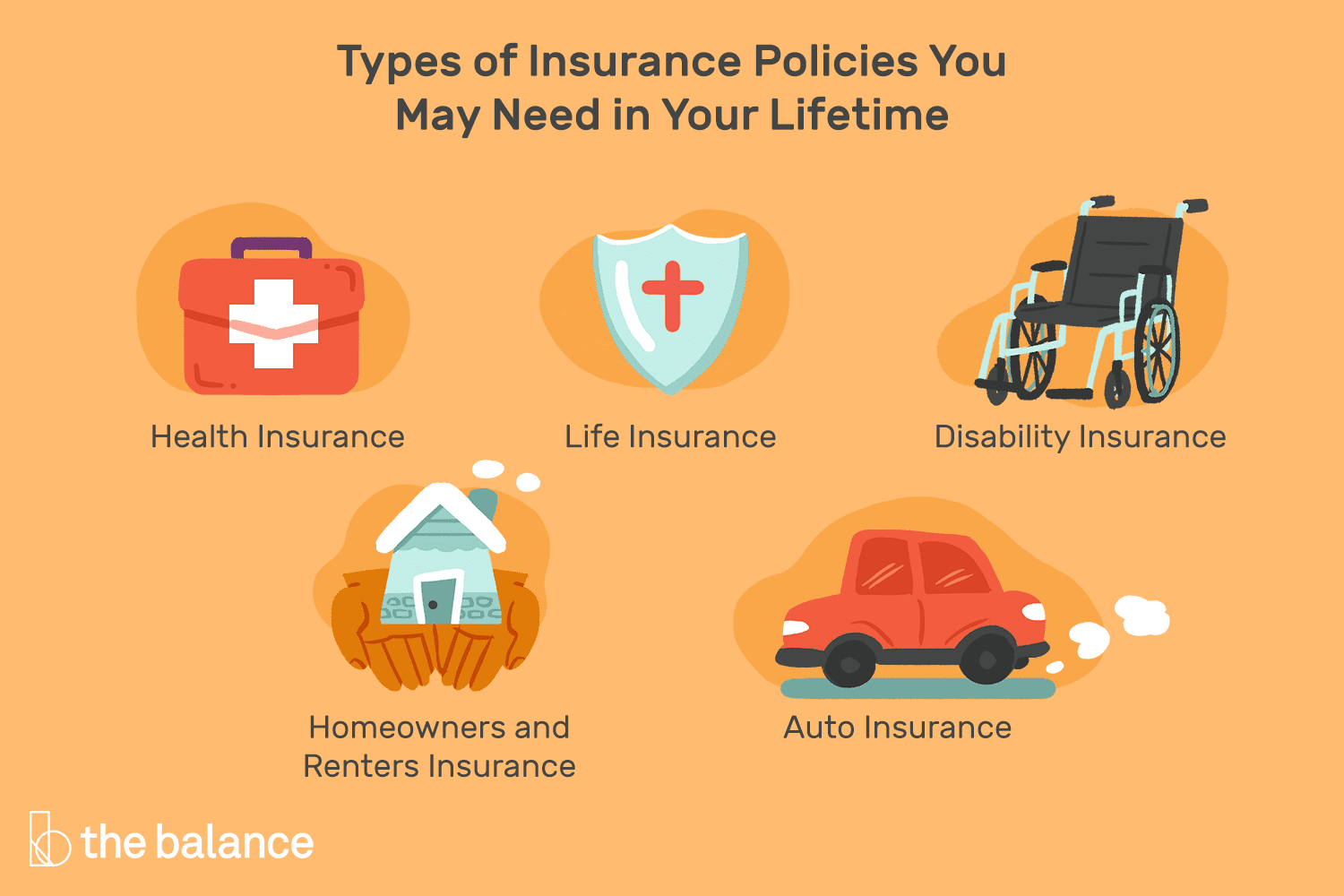

Protect your physical and financial well-being with a comprehensive health insurance plan. Look for coverage that includes preventive care, doctor visits, and hospital stays.

Even if you're not a homeowner, your belongings need protection. Renter's insurance covers your possessions in case of theft, fire, or other disasters.

If you own a vehicle, auto insurance is a must. Research different coverage options, including liability, collision, and comprehensive coverage.

Young Parents As you start a family, your responsibilities grow. Safeguard your loved ones' future with these insurance considerations:

A term life insurance policy can provide financial support to your family if the unexpected happens. Consider coverage that would help pay off debts and provide for your children's needs.

Protect your income with disability insurance, which provides a portion of your salary if you're unable to work due to illness or injury.

If you've purchased a home, this insurance covers your property and belongings, plus liability if someone is injured on your property.

During this stage, your focus may shift to your children's education and your own retirement. Update and expand your insurance coverage:

While not insurance, these plans help you save for your children's education. They offer tax advantages and can ease the financial burden of college tuition.

As your assets grow, consider an umbrella policy that extends liability coverage beyond what's provided by your home and auto insurance.

With children out of the house, you can focus on your own retirement goals and ensure a comfortable future:

With children out of the house, you can focus on your own retirement goals and ensure a comfortable future:

Again, not insurance, but critical for this stage. Contribute to retirement accounts like 401(k)s or IRAs to secure your financial well-being.

If you're downsizing or making home improvements, adjust your homeowner's insurance accordingly.

Evaluate whether you still need life insurance. If your children are financially independent, you may not require as much coverage.

Your insurance needs may change once you retire and no longer have dependents:

Enroll in Medicare and consider supplemental plans to cover medical expenses not included in basic Medicare.

This policy can help cover funeral and end-of-life expenses, ensuring your loved ones are not burdened by these costs.

Life is a series of interconnected stages, and your insurance coverage should evolve alongside them. By carefully considering your unique circumstances at each phase, you can make informed decisions that provide financial security and protect your loved ones. Don't hesitate to consult with insurance professionals to navigate the complexities and ensure your coverage aligns with your ever-changing life journey. Remember, choosing the right insurance policies is a tangible way to show your commitment to safeguarding the future, no matter where life's path leads.