Interest rates play a pivotal role in the world of finance, influencing various aspects of the economy, including consumer spending, investments, and real estate transactions. One of the most significant areas impacted by interest rates is the housing market, specifically mortgage loans. In this blog, we will delve into the intricate relationship between interest rates and mortgage loans, exploring how fluctuations in interest rates can influence borrowers, lenders, and the overall housing market.

A mortgage loan is a substantial financial commitment that allows individuals to purchase real estate without having to pay the entire purchase price upfront. Instead, the borrower agrees to repay the loan amount over an extended period, along with interest, typically through monthly installments. The interest rate on a mortgage loan plays a crucial role in determining the overall cost of the loan and the monthly payments.

When interest rates change, even by a small percentage, it can have a cascading effect on mortgage loans. Let's explore how changes in interest rates impact various stakeholders:

For prospective homebuyers, the interest rate on a mortgage loan significantly influences affordability. When interest rates are low, borrowers can secure loans with lower monthly payments, making homeownership more accessible. Conversely, higher interest rates can lead to increased monthly payments, potentially pricing some buyers out of the market or forcing them to consider more affordable properties.

Lenders, such as banks and credit unions, are also affected by interest rate fluctuations. When interest rates are low, demand for mortgage loans tends to increase, as borrowers seek favorable terms. Lenders may experience a higher volume of loan applications, necessitating efficient processing systems. Conversely, in a high-interest-rate environment, demand for loans may decrease, prompting lenders to adjust their lending strategies to remain competitive.

Interest rates can influence the overall health of the housing market. Lower interest rates stimulate demand for homes, which can lead to increased home prices due to heightened competition. On the other hand, higher interest rates might cool down the housing market by reducing demand and moderating price growth.

When interest rates drop, existing homeowners often consider refinancing their mortgage loans to take advantage of the lower rates. Refinancing can lead to reduced monthly payments, increased disposable income, and potential savings over the life of the loan.

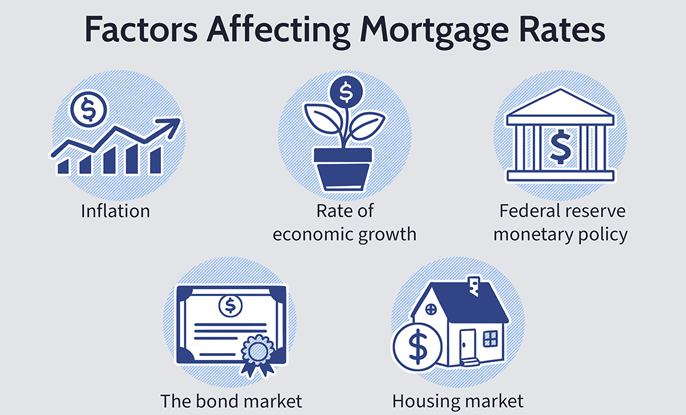

The central bank's monetary policy decisions influence short-term interest rates. During economic downturns, central banks might lower interest rates to stimulate borrowing and spending, which can indirectly support the housing market. Conversely, during periods of economic growth, central banks may raise interest rates to control inflation, potentially impacting mortgage affordability.

The relationship between interest rates and mortgage loans is intricate and multifaceted. Fluctuations in interest rates can have far-reaching effects on borrowers, lenders, the housing market, and the broader economy. Prospective homebuyers should carefully monitor interest rate trends and consider their financial situation when deciding to enter the housing market. Lenders must be prepared to adapt to changing demand and refine their lending strategies. Overall, the impact of interest rates on mortgage loans underscores the interconnectedness of various financial elements and highlights the importance of informed decision-making in both personal and economic contexts.